33+ How much joint mortgage can i get

Please keep me inform email. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Client Information Sheet Real Estate Real Estate Client Real Estate Information Real Estate

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

. Email and calendar plus so much more. There are two different ways you can repay your mortgage. The following table highlights current Redmond mortgage rates.

For joint taxpayers the deduction must be between 4260 and 9580. How The 25x Rule Relates to The 4 Rule. Hh Ohios personal and dependent exemptions are 2400 for an AGI of 40000 or less 2150 if AGI is more than 40000 but less than or equal to 80000 and 1900 if AGI is greater than 80000.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. So if you are going through a divorce you arent the only one. Some couples with a joint mortgage decide to refinance after divorce.

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL. Depending on the contract other events such as terminal illness or critical illness can. Before you start shopping its important to get an idea of how much a lender will give you to purchase your first home.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. In 1885 Goldman took his son Henry and his son-in-law Ludwig Dreyfuss into the business and the firm adopted its present name Goldman Sachs Co. Goldman Sachs was founded in New York City in 1869 by Marcus Goldman.

The student loan interest deduction can be claimed above the line as an adjustment to income. Broadcasting Organisation of Nigeria BON. How Much Mortgage Do You Qualify for.

Like-kind exchanges using qualified exchange accommodation arrangements. You can also input your spouses income if you intend to obtain a joint application for the mortgage. This procedure modifies Rev.

You may think you can afford a. The Old Testament condemns the practice of charging interest on a poor person because a loan should be an act of compassion and taking care of ones neighbor. 3233 dubious discuss It has been said that continuing discrimination in the mortgage industry perpetuates this inequality not only for black homeowners who pay higher mortgage rates than their white counterparts.

Section 179 deduction dollar limits. A common measure of community-wide affordability is the number of homes that a household with a certain percentage of median income can afford. In a 1994 paper William Bengen certified financial planner used historical market and inflation data to determine that a retiree could withdraw 4 of.

40 A 2005 HUD study concluded that small amounts of down payment assistance like this can be very effective in helping renters become homeowners and that as little as 1000 can lead to a 19-percent. With an interest only mortgage you are not actually paying off any of the loan. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

308 to provide that the safe harbor of Rev. Nešeḵ or the taking of clothing as. You can have extra amounts added to your standard amount for.

The effects can be seen in professional educational and personal contexts. Although the program capped assistance at the larger of 10000 or 6 percent of the purchase price the average amount was 5000 per household. By default the table lists refinancing rates though you can click on the Purchase heading to see purchase money mortgages.

It teaches that making a profit off a loan from a poor person is exploiting that person Exodus 222527 Similarly charging of interest Hebrew. Joint Admissions and Matriculation Board JAMB. Lets presume you and your spouse have a combined total annual salary of 102200.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. You can now see lists of all Nigerian Federal Government Media Agencies where you can get the latest federal government jobs in Nigeria in 2022. To work out how much you can get start with your standard amount and add any additional amounts - like housing or childcare.

The mortgage on the joint tenants interest. Capital and interest or interest only. Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage.

Doxim Launches Joint Application Development Initiative to Build Mortgage Broker Channel Integrations With Multiple Participating Credit Unions Read full article September 14 2022 915 AM 4. February 28 2018 at 1233 pm. Youre caring for someone.

In 1882 Goldmans son-in-law Samuel Sachs joined the firm. For men that number is slightly lower at 33 percent. Subsequently they added one child utilizing a quick claim deed creating joint ownership therefore he owns 33 percent of the home.

Work out what other amounts you can get. One way you can end a joint tenancy in Florida real estate is to sell your interest in the property to a stranger. Its subtracted on line 21 of the Adjustments to Income section.

The mortgage should be fully paid off by the end of the full mortgage term. You can quickly see the lists below. 11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for.

You can take it without itemizing or take the standard deduction as well. With a capital and interest option you pay off the loan as well as the interest on it. 2000-37 does not apply to replacement property held in a qualified exchange accommodation arrangement if the property is owned by a taxpayer within the 180-day period.

You can also get them if. Gg Applies to interest and dividend income only. The company pioneered the use of commercial paper for entrepreneurs and joined the New.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1 TB of cloud storage. My friends parents flat out own a home. 233 Within the local authority prevention of care and support needs is closely aligned to other local authority responsibilities in relation to public health childrens services and housing.

You can use the above calculator to estimate how much you can borrow based on your salary. The median multiple indicator recommended by the World Bank and the United Nations rates affordability of housing by dividing the median house price by gross before tax annual median household income.

Infographics Keeping Current Matters Mortgage Rates Mortgage Mortgage Interest Rates

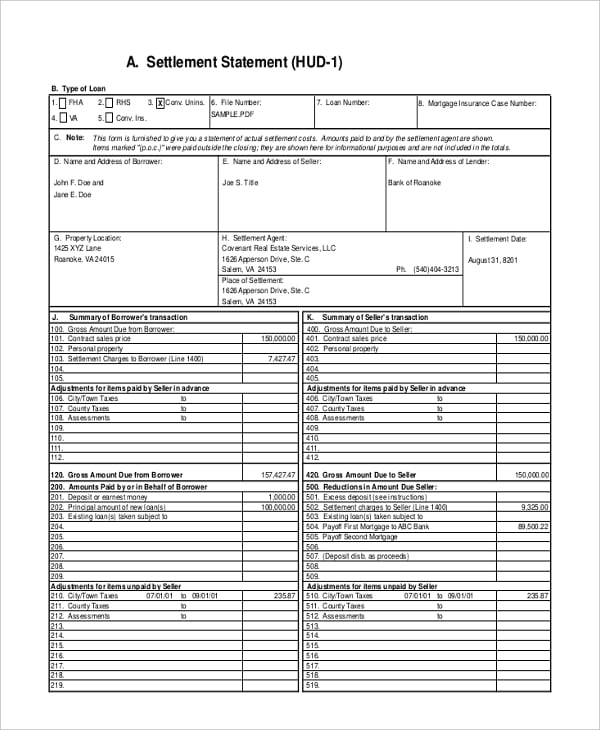

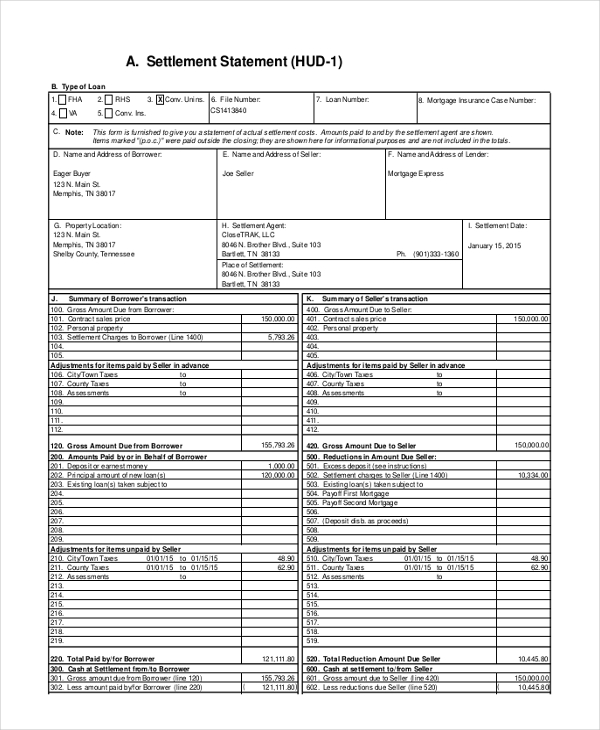

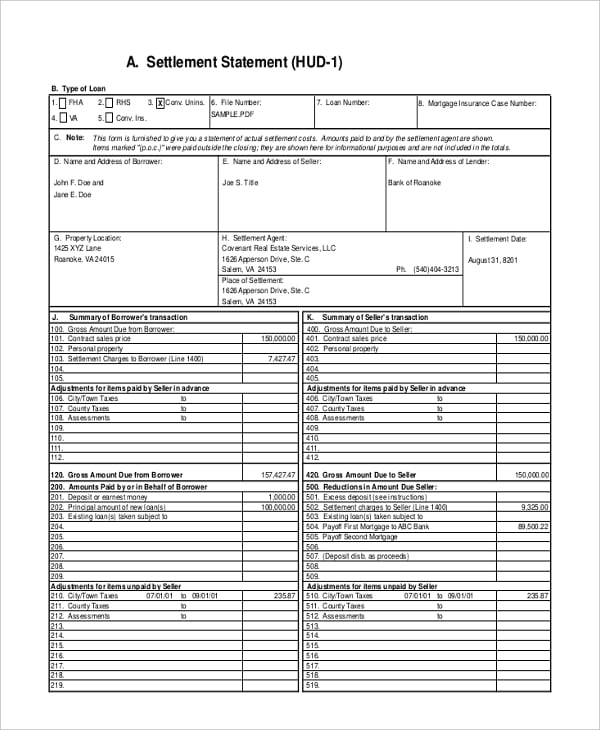

14 Settlement Statement Examples Word Pdf Free Premium Templates

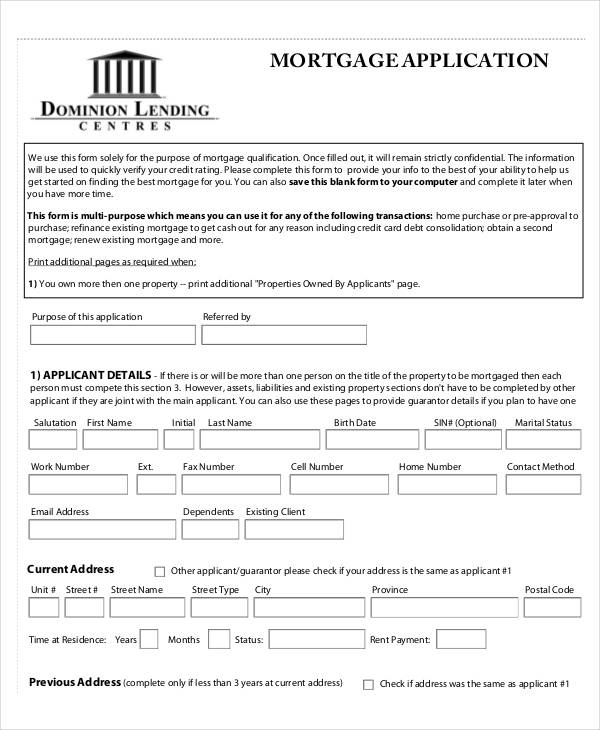

Sample Applications 36 Examples Format Pdf Examples

Graphic Design For Mortgage Broker Magazine Advertising Estateagents Estateagent Estateagentleaflet Mortgage Humor Mortgage Marketing Reverse Mortgage

14 Settlement Statement Examples Word Pdf Free Premium Templates

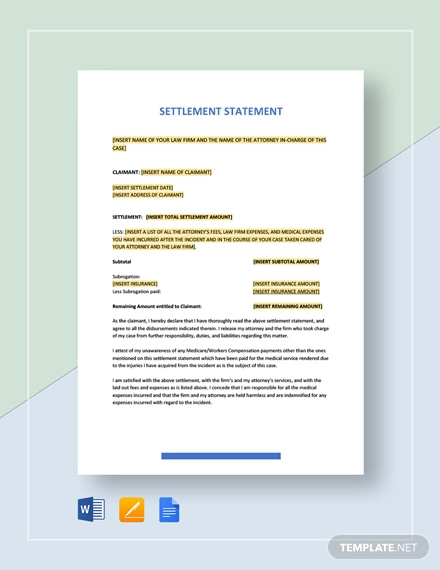

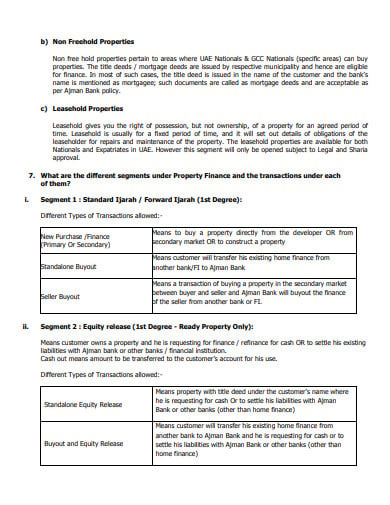

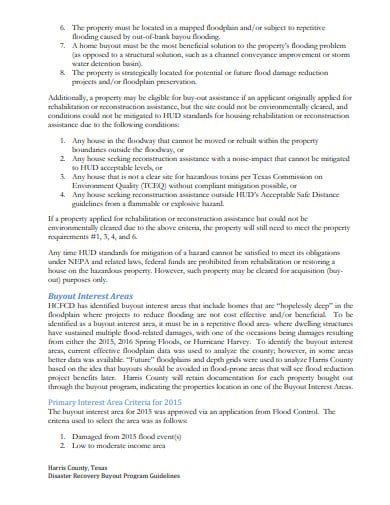

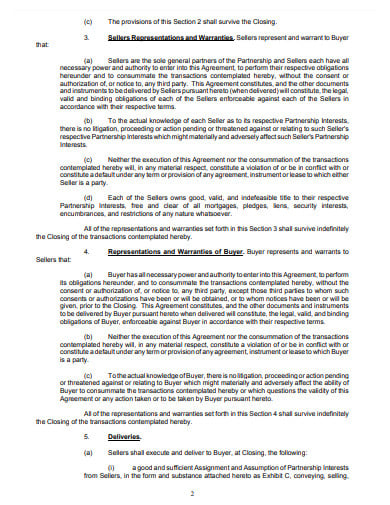

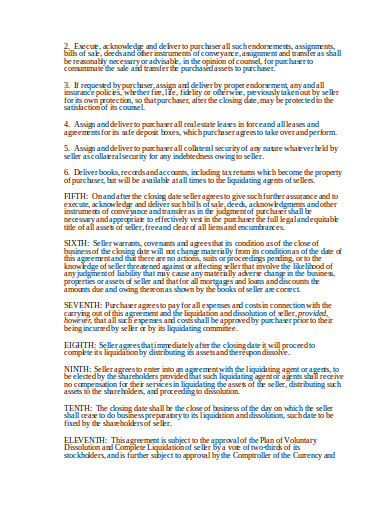

5 Mortgage Buyout Agreement Templates In Doc Pdf Free Premium Templates

5 Mortgage Buyout Agreement Templates In Doc Pdf Free Premium Templates

Apartment Condo Mortgage Broker Tri Fold Brochure Template Illustrator Indesign Word Apple Pages Psd Publisher Template Net Trifold Brochure Template Trifold Brochure Wellness Design

5 Mortgage Buyout Agreement Templates In Doc Pdf Free Premium Templates

5 Mortgage Buyout Agreement Templates In Doc Pdf Free Premium Templates

5 Mortgage Buyout Agreement Templates In Doc Pdf Free Premium Templates

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

Don T Be Fooled Homeownership Is A Great Investment Infographic Real Estate Advice Real Estate Buyers Home Ownership

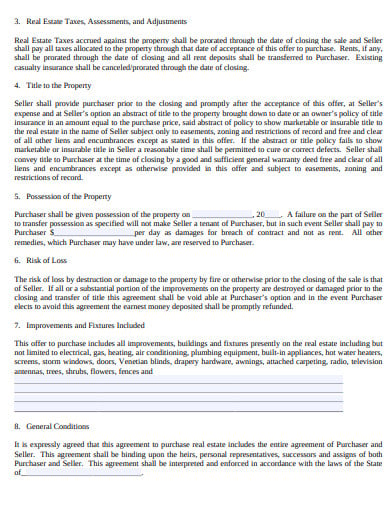

Dissolution Agreement Template Sample

14 Settlement Statement Examples Word Pdf Free Premium Templates

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

Amp Pinterest In Action Joint Venture Joint Venture